child tax credit september 2021

13 opt out by Aug. The third payments of 2021 are scheduled to go out to the parents of roughly 60 million children in September courtesy of the Internal Revenue Service IRS.

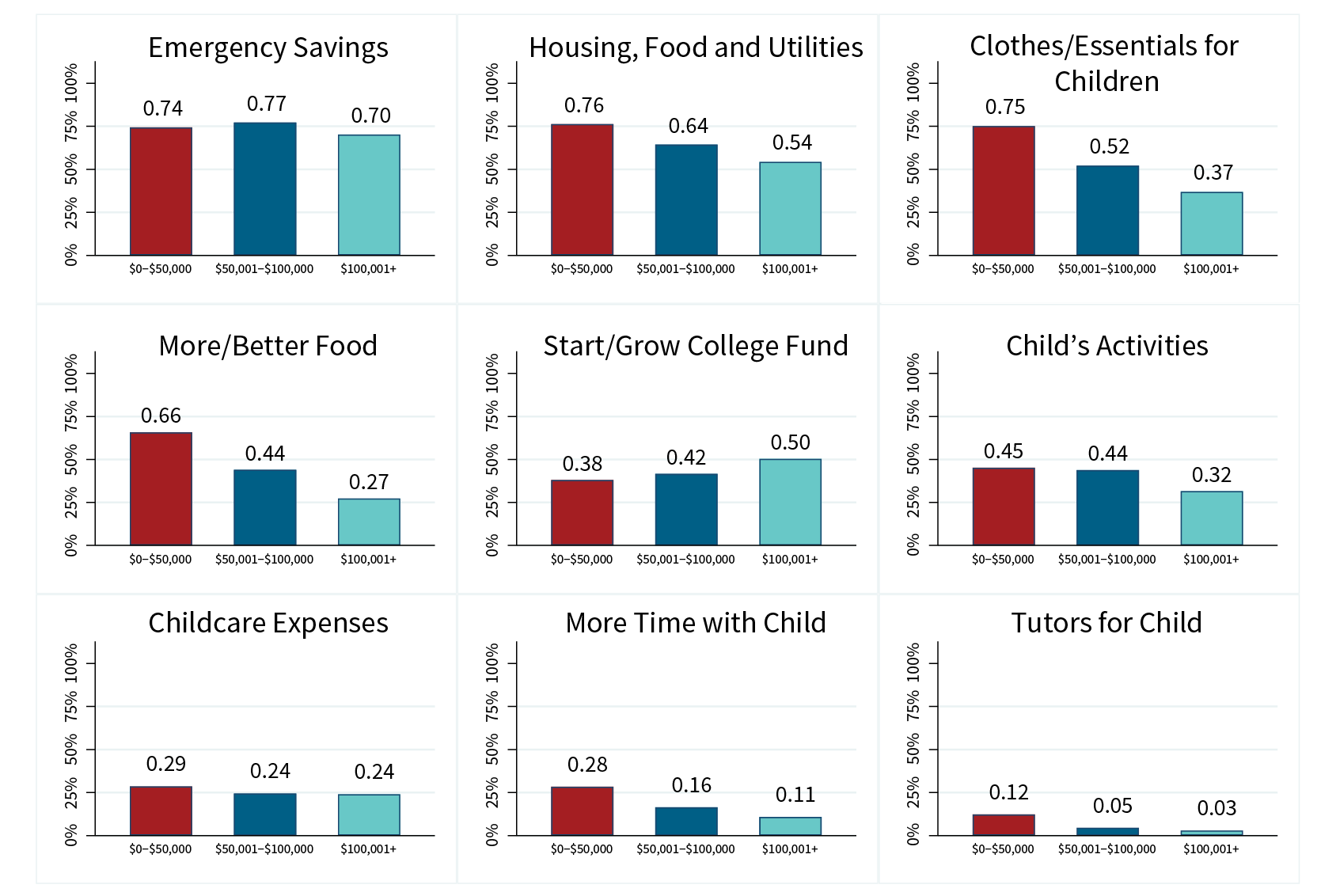

The New Child Tax Credit Does More Than Just Cut Poverty

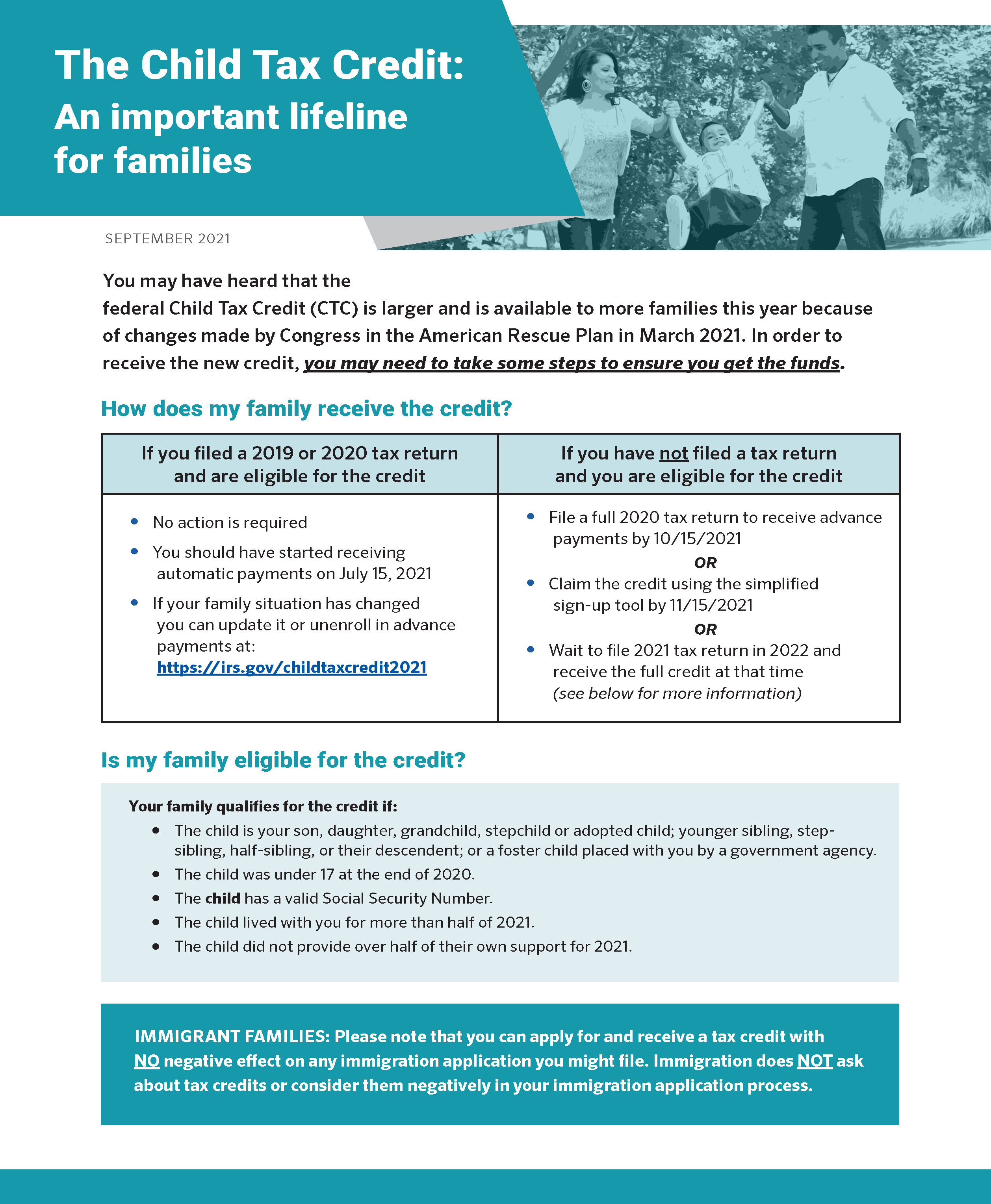

The American Rescue Plan increased the amount of the Child Tax Credit from 2000 to 3600 for qualifying children under age 6 and 3000 for.

. IR-2021-188 September 15 2021. However a child born or added to your family such as through adoption in 2021 can be a qualifying child for the full 2021 Child Tax Credit even if you did not receive monthly Child Tax. Some families received part of their 2021 Child Tax Credit through monthly payments from July to December 2021.

The third monthly payment of the expanded Child Tax Credit CTC kept 34 million children from poverty in September 2021. Well tell you when this payment will arrive and how to unenroll. Though the Internal Revenue Service sent out the third monthly child tax credit payment last week some families are still waiting for the funds.

The monthly child poverty rate increased between. We need this money. The maximum credit amount has increased to 3000 per qualifying child between ages 6 and 17 and 3600 per qualifying child under age 6.

The child tax credit was expanded for the 2021 tax year to a total of 3600 for children 5 and younger and 3000 for those 6 through 17. The third monthly payment of the enhanced Child Tax Credit is landing in bank accounts on Wednesday providing an influx of. T21-0226 Tax Benefit of the Child Tax Credit CTC Extend ARP Provisions but Retain Current-Law Partial Refundability by Expanded Cash Income Level 2022.

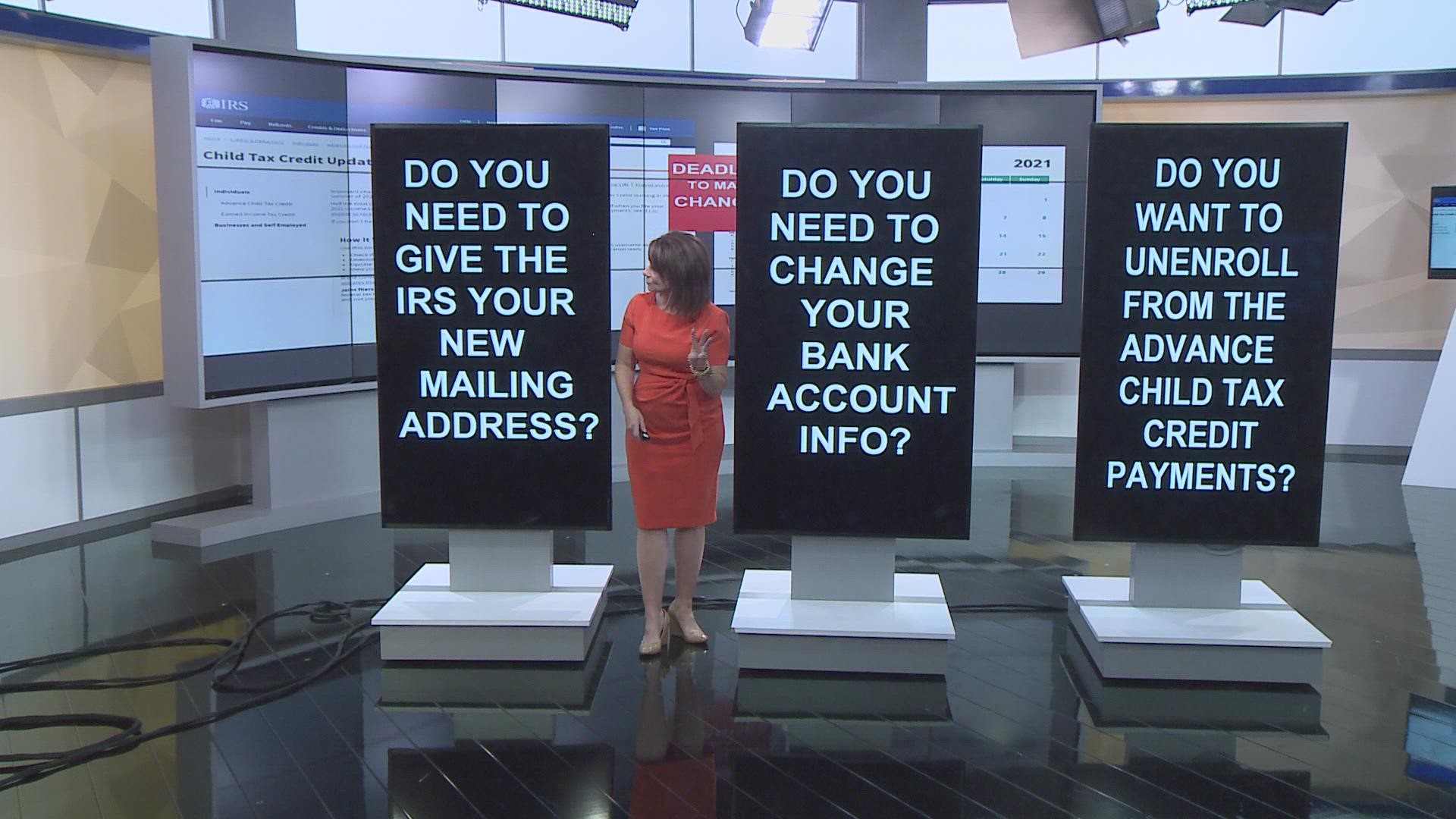

15 opt out by Aug. The 2021 child tax credit payment dates along with the deadlines to opt out are as follows. The IRS has confirmed that theyll soon allow.

WASHINGTON The Internal Revenue Service and the Treasury Department announced today that millions of American families are now. Fri September 24 2021 Link. Millions of families across the US will be receiving their third advance child tax credit.

An income increase in 2021 to an amount above the 75000 150000 threshold could lower a households Child Tax Credit. The American Rescue Plan Act of 2021 increased the amount of the CTC for the 2021 tax year only for most taxpayers. Only one child tax credit payment is left this year.

To receive the rest you need to file a tax return. The credit amount was increased for 2021. If youre eligible you could receive.

This week the IRS successfully delivered a third monthly round of approximately 35 million Child Tax Credits with a total value of about 15 billion. September 10 2021 at 700 am. Total child tax credit payments between 2021 and 2022 could be up to 3600 per kid.

Parents report problems receiving September child tax credit Published Fri Sep 17 2021 318 PM EDT Updated Fri Sep 17 2021 729 PM EDT Alicia. September 17 2021. For 2021 the credit amount is.

September 16 2021 735 AM MoneyWatch.

About The 2021 Expanded Child Tax Credit Payment Program

T21 0223 Tax Expenditure For The Child Tax Credit Billions 2022 25 Tax Policy Center

Temui Video Popular Child Tax Credit Eligible Tiktok

Child Tax Credit Unenroll Deadline For September Is Approaching 10tv Com

Parents Reflect On The Importance Of The Child Tax Credit

Tax Tip Update Your Address By August 30 For September Advance Child Tax Credit Payments

The Child Tax Credit An Important Lifeline For Families North Carolina Justice Center

Nearly A Third Of Parents Spent Child Tax Credit On School Expenses

Expanded Child Tax Credit Continues To Keep Millions Of Children From Poverty In September A Columbia University Center On Poverty And Social Policy

Child Tax Credit 2021 Payments To Be Disbursed Starting July 15 Here S When The Money Will Land Cbs News

Irs Child Tax Credit No September Payment Track Your Check

The Child Poverty Rate Fell By Nearly Half In 2021 As Enhanced Child Tax Credit Sent Billions Of Dollars To Families

Payments For The New 3 000 Child Tax Credit Start July 15 Here S What You Should Know Brinker Simpson

Missing Your September Child Tax Credit Payment You Re Not Alone

Irs Investigating Why Some Families Didn T Receive September Child Tax Credit

Faith Leaders Urge Minimum Wage Hike Expanded Child Tax Credit As Congress Nears Recess Kansas Reflector

Lawmakers Urged To Extend Changes To Child Tax Credit New Hampshire Bulletin

Brproud Irs Issues Warning As Next Batch Of Child Tax Credit Payments Are Set To Go Out Next Month

Assisting Non Filers With The Child Tax Credit Ctc Better Health Together